Knowledge Base |

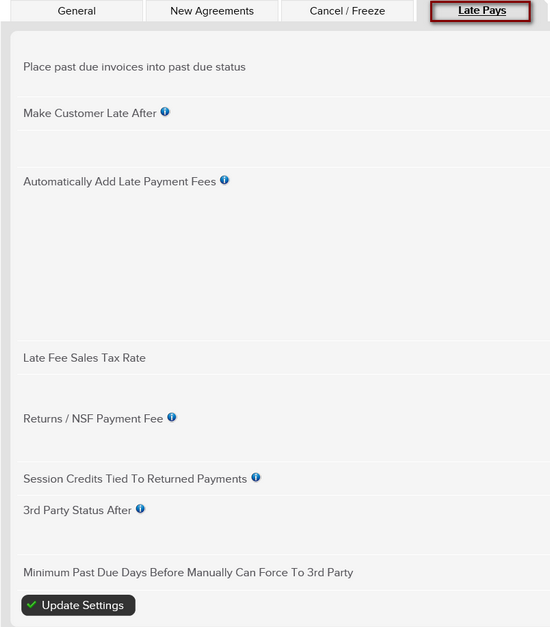

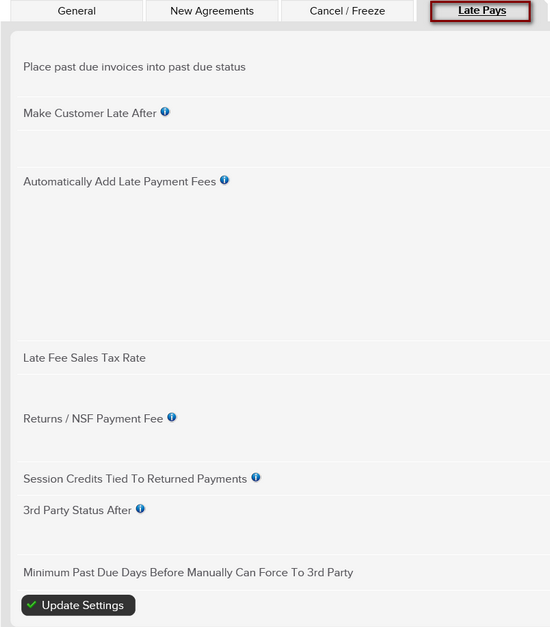

Setup / Edit Late Pay Settings

|

This article will guide you through accessing and

changing your late pay settings. If you are a full service club, contact ClubReady support for additional information.

Requirements - A Master Admin login or a staff type with the following permissions:

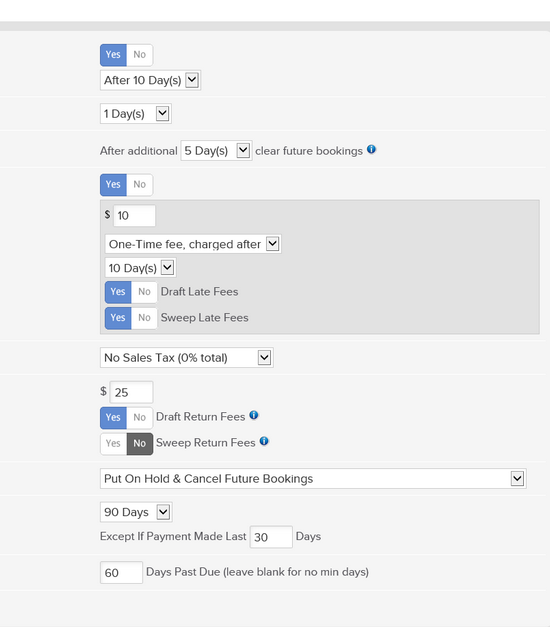

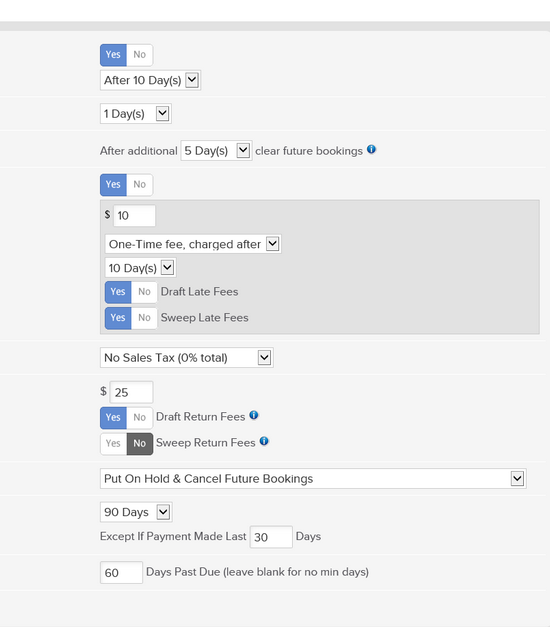

Make Customer Late After - You can set the day at which you consider a customer past due.

Automatically Add Late Payment Fees - Allows you to control whether and how soon (in days) a client is assessed a late fee for an invoice that has not been paid. You may add a late fee one-time per invoice or as a recurring fee per invoice. You may choose if you want these fees to be draft able and/or if you have Sweep dates enabled if late fees can be collected via a sweep.

Late Fee Sales Tax Rate - Apply the sales tax to your late fee invoices, if applicable.

Returns / NSF Payment Fee - Allows you to charge the client for any returned bank ACH payments or bounced check and also chargebacks (credit card disputes).

Draft Return Fees - Attempt to draft Returned Payment Fees. This setting only applies to future Return Fees.

Sweep Return Fees - Attempt to Sweep Returned Payment Fees. This setting only applies to future Return Fees. Return Fees must be set to Draft before this can be enabled.

Session Credits Tied To Returned Payments - This setting controls what happens to credits tied to an invoice if a payment is marked as a return or chargeback.

3rd Party Status After - This will allow you to specify after how many days the account will be moved to third party collections. This will result in the agreement being cancelled and all unpaid invoices considered in third party. These agreements will be placed into a third party report which you may use to collect internally or send to a third party company to collect from the customer on your behalf.

Minimum Past Due Days Before Manually Can Force To 3rd Party - This option allows you to set the minimum amount of days before staff can manually force a client into third party collections.\

This

feature will allow you to place invoices into late status after a

certain amount of time if you select Yes.

If "No" is selected the client and invoices will appear past due. If the funds are collected for any invoice that was placed into past due status those funds will appear on your Gross Sales report under the Past Due category. This option is

used for internal past due collections processing, 3rd party collections will be

addressed in a later step.

Select whether you would like unused service and class credits to go on hold and open bookings cancelled if the client goes past due. If you choose this option you can select a grace period to to allow time for the client to pay outstanding invoices before affecting their unused and booked credits.

Select

Yes if you want a late fee to be applied to each past due invoice.If you click Yes enter a desired fee amount.The next option for this feature is to select whether you want the fee to be charged One-Time fee, charged after or Recurring fee, charged every. A one-time fee is applied to each invoice once or recurring will apply the fee to an invoice continuously per the days selected next. For example invoice for Jan 1st is past due: One-Time fee will charge one late fee to this invoice, Recurring fee will charge the late fee multiple times to this invoice.Once you have made your selection you will then select how often (in days) the fee(s) are applied.If you select the Recurring fee, charged every option a drop-down will appear for you to select how many times the fee should be applied to an individual invoice.

Enter the fee you wish to invoice a client if you get any returned bank ACH or checks and also chargebacks (credit card disputes) from the clients bank/card company.

5. Session Credits Tied To Returned Payments

You may choose an event to occur if a payment is returned via bank ACH, written check, or chargeback.

Requirements - A Master Admin login or a staff type with the following permissions:

- Setup: Can access setup

- Setup: Can access sales general settings

Accessing Late Pay Settings

To define your Late Pay Settings, go to; Setup > Sales > Sales Settings > Late Pays. There options under late pay settings include:

Make Customer Late After - You can set the day at which you consider a customer past due.

Automatically Add Late Payment Fees - Allows you to control whether and how soon (in days) a client is assessed a late fee for an invoice that has not been paid. You may add a late fee one-time per invoice or as a recurring fee per invoice. You may choose if you want these fees to be draft able and/or if you have Sweep dates enabled if late fees can be collected via a sweep.

Late Fee Sales Tax Rate - Apply the sales tax to your late fee invoices, if applicable.

Returns / NSF Payment Fee - Allows you to charge the client for any returned bank ACH payments or bounced check and also chargebacks (credit card disputes).

Draft Return Fees - Attempt to draft Returned Payment Fees. This setting only applies to future Return Fees.

Sweep Return Fees - Attempt to Sweep Returned Payment Fees. This setting only applies to future Return Fees. Return Fees must be set to Draft before this can be enabled.

Session Credits Tied To Returned Payments - This setting controls what happens to credits tied to an invoice if a payment is marked as a return or chargeback.

3rd Party Status After - This will allow you to specify after how many days the account will be moved to third party collections. This will result in the agreement being cancelled and all unpaid invoices considered in third party. These agreements will be placed into a third party report which you may use to collect internally or send to a third party company to collect from the customer on your behalf.

Minimum Past Due Days Before Manually Can Force To 3rd Party - This option allows you to set the minimum amount of days before staff can manually force a client into third party collections.\

1. Place Past Due Invoices Into Late Status

2. Booking / Credit Handling For Past Due Customers

3. Automatically Add Late Payment Fees

4. Returns / NSF Payment Fee

5. Session Credits Tied To Returned Payments

You may choose an event to occur if a payment is returned via bank ACH, written check, or chargeback.